With the start of the new financial year, companies are reaching out to their employees to select the tax regime for 2024-25. This is an important decision because you can do it only once in a financial year. Once you make a choice, your income will be taxed as per the tax structure of that regime. Last year’s Budget had made the new tax regime the default option for salaried taxpayers. The employees who did not inform their companies about the tax regime they preferred were automatically put in the new tax regime.

New Tax Regime

A new tax regime was introduced in Budget 2020 wherein the tax slabs were altered, and taxpayers were offered concessional tax rates. However, those who opt for the new regime cannot claim several exemptions and deductions, such as HRA, LTA, 80C, 80D , and more. Because of this, the new tax regime did not have many takers. The government in the Budget 2023 introduced 5 key changes, which remain the same even for FY 2024-2025 since no changes were made in the Interim Budget 2024, to encourage taxpayers to adopt the new regime. They are:

- Higher Tax Rebate Limit: Full tax rebate on an income up to ₹7 lakhs has been introduced. Whereas this threshold is ₹5 lakhs under the old tax regime. This means that taxpayers with an income of up to ₹7 lakhs will not have to pay any tax at all under the new tax regime!

- Streamlined Tax Slabs: The tax exemption limit has been increased to ₹3 lakhs, and the new tax slabs are:

| Total Income | Rate of Tax |

| up to ₹3,00,000 | Nil |

| ₹3,00,001- ₹6,00,000 | 5% |

| ₹6,00,001- ₹9,00,000 | 10% |

| ₹9,00,001- ₹12,00,000 | 15% |

| ₹12,00,001- ₹15,00,000 | 20% |

| ₹15,00,001 and above | 30% |

- The tax rates under both regimes are compared as below:

| Income Slab | Old Tax Regime | New tax Regime (until 31st March 2023) | New Tax Regime (From 1st April 2023) |

| ₹0 – ₹2,50,000 | – | – | – |

| ₹2,50,000 – ₹3,00,000 | 5% | 5% | – |

| ₹3,00,000 – ₹5,00,000 | 5% | 5% | 5% |

| ₹5,00,000 – ₹6,00,000 | 20% | 10% | 5% |

| ₹6,00,000 – ₹7,50,000 | 20% | 10% | 10% |

| ₹7,50,000 – ₹9,00,000 | 20% | 15% | 10% |

| ₹9,00,000 – ₹10,00,000 | 20% | 15% | 15% |

| ₹10,00,000 – ₹12,00,000 | 30% | 20% | 15% |

| ₹12,00,000 – ₹12,50,000 | 30% | 20% | 20% |

| ₹12,50,000 – ₹15,00,000 | 30% | 25% | 20% |

| >₹15,00,000 | 30% | 30% | 30% |

- Standard Deduction and Family Pension Deduction:

- Salary income: The standard deduction of ₹50,000, which was only available under the old regime, has now been extended to the new tax regime as well. This, along with the rebate, makes ₹7.5 lakhs as your tax-free income under the new regime.

- Family pension: Those receiving a family pension can claim a deduction of ₹15,000 or 1/3rd of the pension, whichever is lower.

- Reduced Surcharge for High Net Worth Individuals: The surcharge rate on income over ₹5 crores has been reduced from 37% to 25%. This move will bring down their effective tax rate from 42.74% to 39%.

- Higher Leave Encashment Exemption: The exemption limit for non-government employees has been raised from ₹3 lakhs to ₹25 lakhs, an 8-fold increase.

- Default Regime: Starting from FY 2023-24, the new income tax regime will be set as the default option. If you want to continue using the old regime, you must submit the income tax return along with Form 10IEA before the due date. You will have the option to switch between the two regimes annually to check the tax benefits.

Old Tax Regime

The old regime is the tax system that prevailed before the introduction of the new regime. Under this regime, there are over 70 exemptions and deductions available, including HRA and LTA, that can reduce your taxable income and lower tax payments. The most popular and generous deduction is Section 80C, which allows for a reduction of taxable income up to Rs.1.5 lakh. The taxpayers are given a choice between the old and the new tax regime.

Difference Between Old Vs New Tax Regime: Which is Better?

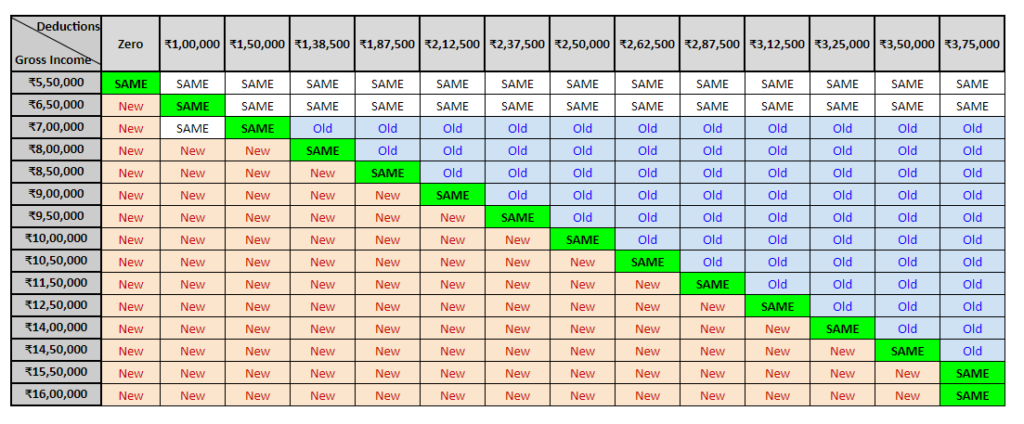

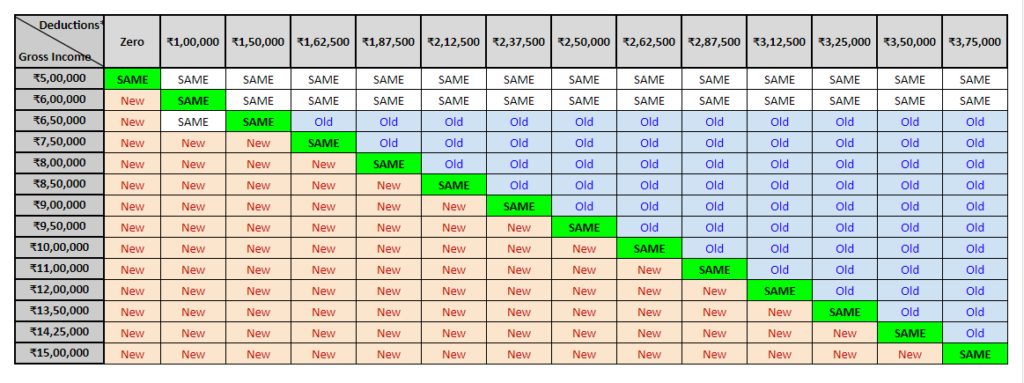

The decision to switch to the new or remain in the old tax regime or which regime is better for you shall be based on the tax savings deductions and exemptions you are eligible for in the old tax regime. To make it easier, we have calculated a breakeven point for various income levels (refer to the table below) for a salaried individual below 60 years of age. This can be used to determine which regime to choose.

The breakeven threshold for deciding between New vs Old tax regimes

The Breakeven point is that amount where there will be no difference in tax liability between the two tax regimes.

If your total eligible deductions and exemptions in the old tax regime are higher than the breakeven threshold for your income level, it is advisable to stay in the old regime. On the other hand, if the breakeven threshold is higher, then moving to the new tax regime is more beneficial.

If you have salary income:

| Income Level | Less: Standard Deduction | Net Income | Tax under both regimes | Additional Deductions (over & above standard deduction) required in Old Regime to Break Even | Which Regime to choose old or new tax regime |

| ₹7,00,000 | ₹50,000 | ₹6,50,000 | ₹0 | ₹1,50,000 | You will benefit only in new regime. |

| ₹8,00,000 | ₹50,000 | ₹7,50,000 | ₹36,400 | ₹1,38,500 | Old regime: if deductions > Rs 1,38,500 New regime: if deductions < Rs 1,38,500 |

| ₹9,00,000 | ₹50,000 | ₹8,50,000 | ₹41,600 | ₹2,12,500 | Old regime: if deductions > Rs 2,12,500 New regime: if deductions < Rs 2,12,500 |

| ₹10,00,000 | ₹50,000 | ₹9,50,000 | ₹54,600 | ₹2,50,000 | Old regime: if deductions > Rs. 2,50,000 New regime: if deductions < Rs 2,50,000 |

| ₹12,50,000 | ₹50,000 | ₹12,00,000 | ₹93,600 | ₹3,12,500 | Old regime: if deductions > Rs. 3,12,500 New regime: if deductions < Rs 3,12,500 |

| ₹15,00,000 | ₹50,000 | ₹14,50,000 | ₹1,45,600 | ₹3,58,000 | Old regime: if deductions > Rs. 3,58,000 New regime: if deductions < Rs 3,58,000 |

| ₹15,50,000 | ₹50,000 | ₹15,00,000 | ₹1,56,000 | ₹3,75,000 | Old regime: if deductions > Rs. 3,75,000 New regime: if deductions < Rs 3,75,000 |

| ₹16,00,000 | ₹50,000 | ₹15,50,000 | ₹1,71,600 | ₹3,75,000 | Old regime: if deductions > Rs. 3,75,000 New regime: if deductions < Rs 3,75,000 |

If you have income other than salary:

Tax under Old vs New Regime

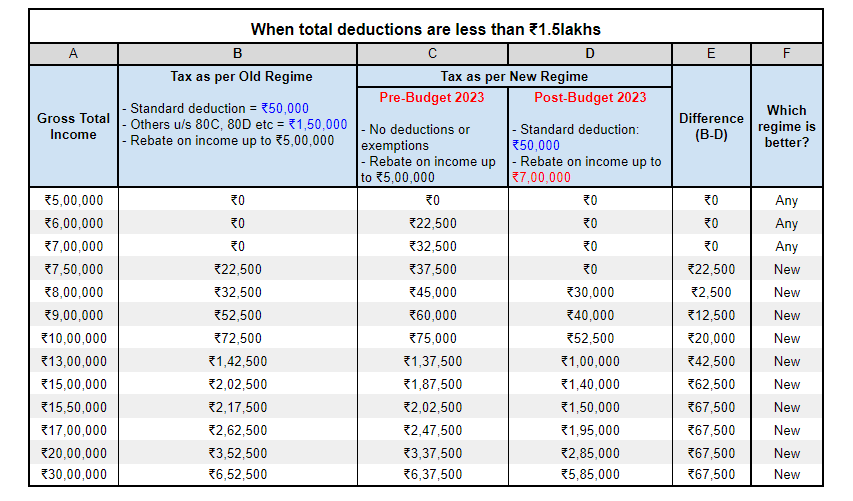

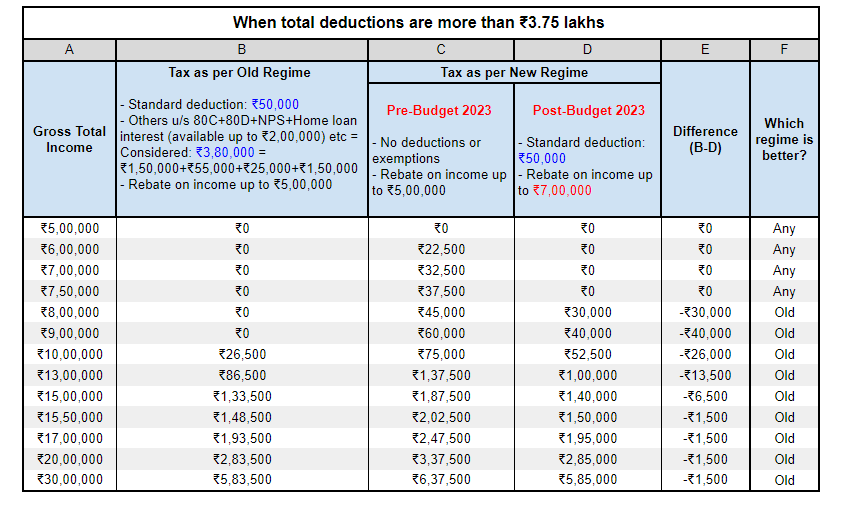

Here are a few calculations that will help you decide between the old vs the new tax regime:

- When total deductions are ₹1.5 lakhs or less: The new regime will be beneficial

- When total deductions are more than ₹3.75 lakhs: The old regime will be beneficial

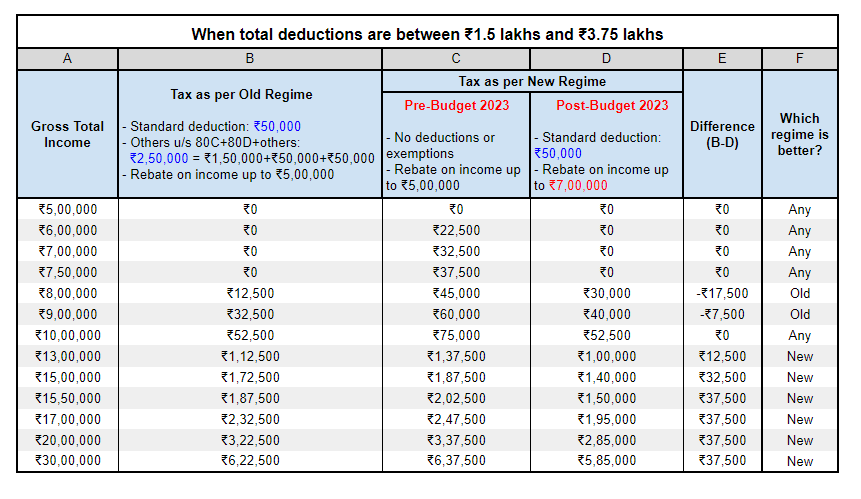

- When total deductions are between ₹1.5 lakhs to ₹3.75 lakhs: will depend on your income level.

When total deductions are ₹1.5 lakhs or less: The new tax regime will be beneficial

When total deductions are more than ₹3.75 lakhs: The old tax regime will be beneficial

When total deductions are between ₹1.5 lakhs to ₹3.75 lakhs: Will depend on various income levels

What deductions and exemptions are allowed under the new tax regime?

Here is a comparison between the deductions and exemptions available under the new and the old tax regime:

| Particulars | Old Tax Regime | New tax Regime (until 31st March 2023) | New Tax Regime (From 1st April 2023) |

| Income level for rebate eligibility | ₹ 5 lakhs | ₹ 5 lakhs | ₹ 7 lakhs |

| Standard Deduction | ₹ 50,000 | – | ₹ 50,000 |

| Effective Tax-Free Salary income | ₹ 5.5 lakhs | ₹ 5 lakhs | ₹ 7.5 lakhs |

| Rebate u/s 87A | ₹12,500 | ₹12,500 | ₹25,000 |

| HRA Exemption | ✓ | X | X |

| Leave Travel Allowance (LTA) | ✓ | X | X |

| Other allowances including food allowance of Rs 50/meal subject to 2 meals a day | ✓ | X | X |

| Standard Deduction (Rs 50,000) | ✓ | X | ✓ |

| Entertainment Allowance and Professional Tax | ✓ | X | X |

| Perquisites for official purposes | ✓ | ✓ | ✓ |

| Interest on Home Loan u/s 24b on: Self-occupied or vacant property | ✓ | X | X |

| Interest on Home Loan u/s 24b on: Let-out property | ✓ | ✓ | ✓ |

| Deduction u/s 80C (EPF | LIC | ELSS | PPF | FD | Children’s tuition fee etc) | ✓ | X | X |

| Employee’s (own) contribution to NPS | ✓ | X | X |

| Employer’s contribution to NPS | ✓ | ✓ | ✓ |

| Medical insurance premium – 80D | ✓ | X | X |

| Disabled Individual – 80U | ✓ | X | X |

| Interest on education loan – 80E | ✓ | X | X |

| Interest on Electric vehicle loan – 80EEB | ✓ | X | X |

| Donation to Political party/trust etc – 80G | ✓ | X | X |

| Savings Bank Interest u/s 80TTA and 80TTB | ✓ | X | X |

| Other Chapter VI-A deductions | ✓ | X | X |

| All contributions to Agniveer Corpus Fund – 80CCH | ✓ | Did not exist | ✓ |

| Deduction on Family Pension Income | ✓ | X | ✓ |

| Gifts upto Rs 50,000 | ✓ | ✓ | ✓ |

| Exemption on voluntary retirement 10(10C) | ✓ | ✓ | ✓ |

| Exemption on gratuity u/s 10(10) | ✓ | ✓ | ✓ |

| Exemption on Leave encashment u/s 10(10AA) | ✓ | ✓ | ✓ |

| Daily Allowance | ✓ | ✓ | ✓ |

| Conveyance Allowance | ✓ | ✓ | ✓ |

| Transport Allowance for a specially-abled person | ✓ | ✓ | ✓ |

How to choose between old and new tax regimes?

When deciding between the two tax regimes, it is important to take into account the tax exemptions and deductions available under the old tax regime. After deducting all eligible exemptions and deductions, the net taxable income can be determined. By calculating the tax liability based on this net taxable income under the old tax regime, it becomes possible to compare it with the tax liability under the new tax regime.

Choosing the regime with the lower tax liability is the logical approach, and it is essential to inform the employer about this choice so that the appropriate Tax Deducted at Source (TDS) can be deducted from the salary.

If you have a loss from house property, capital gains, or business & profession, you need to consider them as well while making informed decisions on the selection of regime. Along with the current year’s losses, even the previous year’s losses eligible to set off will get lapsed as well. Ineligibility to carry forward such losses may impact your future income determination and taxes thereon.

Conclusion

Many individuals often find themselves questioning the disparities between the old and new tax regimes. The new income tax regime is designed to accommodate those who have more personal commitments such as repayment of personal/vehicle loans, medical treatment of parents or dependents, or wish to avoid the burden of extensive tax preparation or have minimal tax deductions due to their ineligibility for section 10 exemptions, standard deductions, tax on employment, employer contribution to pension scheme etc., Conversely, the old tax regime can yield more tax savings for senior citizens, who derive a substantial portion of their income from interest, can benefit from Section 80TTB, which allows them to claim Rs.50,000 as interest income deduction and feel more secure under the old tax regime.

Both the old and new tax regimes possess advantages and disadvantages. The previous tax structure encourages taxpayers to cultivate a habit of saving, while the new tax structure favours employees with lower earnings and investments, resulting in fewer deductions and exemptions. The new tax system is considered safer and simpler, involving fewer records and reducing the potential for tax evasion fraud. However, due to the unique nature of individual deductions and exemptions, a thorough comparison of the two regimes is necessary to determine the best fit for each person.